The researchers also found that of those who had made a will, many who had experienced a significant life event, such as marriage or having a baby, had not done anything to update it or their legacy plans.

“…three in ten (31%) experienced a significant life event such as marriage or having a baby, yet more than half (53%) have not updated their will.”

But having a will setting out what you wish to happen to your children if you die before they reach 18 is the only legal way to be sure they will be provided for and brought up in the way you wish. Similarly, did you know that on marriage, your will becomes automatically invalidated, and on divorce, any gift or appointment in your will to an ex-spouse is invalidated?

Whether moving in together, marrying, entering a civil partnership, having children, divorcing, re-marrying or a new civil partnership, each of these momentous life stages has an important impact on the outcome if you were to die without leaving a will.

That’s why it is so important to have one in place and to keep it up to date, yet so many of us resist managing what will happen when we die. For some, they think having a will and legacy planning is only for the wealthy; some simply want to avoid making difficult decisions.

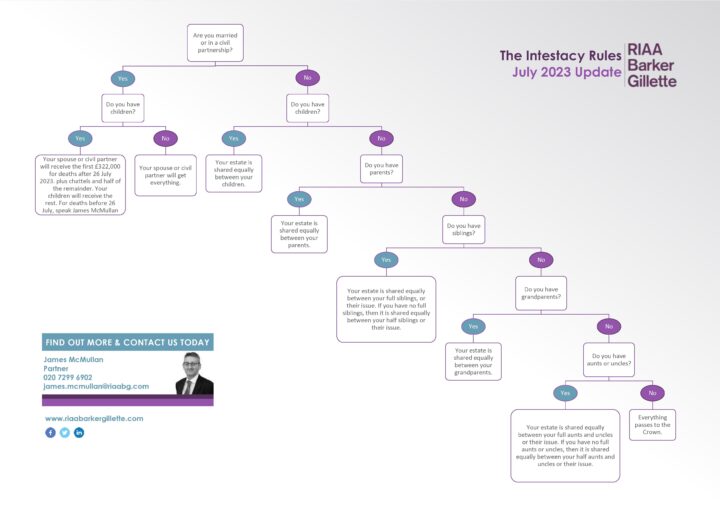

For others, it’s because they believe the urban myths around what happens on death, imagining their assets go automatically to their partner or that their family will be able to decide how to distribute them. That is not the case, as without a will the intestacy rules come into play. These are a strict set of rules which govern how a person’s estate is distributed if they die without a will – which is known as dying ‘intestate’.

What’s the problem with allowing the intestacy rules to apply?

Just two examples are that the rules do not include any provision for cohabiting partners, and children under 18 can receive assets without any control over how the money is spent.

In such circumstances, it is unlikely that you would want this to be the outcome and emphasises the importance of how you approach making a will. It is not something to be set in stone and locked away to gather dust but should be a living document. It should reflect your wishes at the time you write it, but as life moves on and your circumstances change, so should your will and inheritance planning.

Writing a will is also a good time for couples to consider inheritance tax implications, particularly for those who are cohabiting, as they will not benefit from the inheritance tax exemptions and transfers available to spouses and civil partners.

So, when should you think about writing or updating your will?

Let’s look at what happens at some key life stages:

Buying a property

If you buy a property alone and have no children and no partner to consider, you may feel you can leave things to the intestacy roulette wheel, which would distribute the value to parents or close relatives if you were to die. But in most circumstances, you will want to protect the interests of those close to you. This is particularly important for cohabiting couples who buy a property together or agree that one has become entitled to a share or where children are involved from previous relationships.

The ownership needs to be structured to reflect this and the intentions of each upon death. Property can be owned as ‘joint tenants’, where there are no defined shares in the property, irrespective of contribution. Here, the whole property would pass automatically to the other when the first dies, regardless of the intestacy rules or any will. Or it can be owned as ‘tenants in common’, where each will own a specific share – which can be in any proportion, by any agreed calculation – leaving them free to choose what happens to their share of the property on death. This enables a share to be left to children or others directly; it can also be structured within your will to allow the survivor to continue living in the house until they die or for a set period, as explained below.

Protecting assets for children from an earlier relationship

A common challenge is around ring-fencing assets you bring into the relationship and how to provide for children from previous relationships.

Together with appropriately structured property ownership, using trusts can offer effective solutions to practical day-to-day problems. Say, for example, that in your new relationship, you each wish to provide for the other while making sure that children from an earlier relationship do not miss out. These two objectives can be achieved quite simply if a couple leaves their estate, or whatever proportion they choose, in trust for the survivor and then to their respective children following the survivor’s death. This way, if the husband dies first, his wife will have the use of the assets in his estate for the rest of her life, but when she dies, those assets will pass to the husband’s children.

While you need specialist help to get trusts right, it’s not something that is just for the wealthy and should be a straightforward aspect of drawing up your will for a solicitor experienced in this area, including those who are members of the Society of Trust & Estate Practitioners (STEP), like our partner and head of private client, James McMullan who is a full member of STEP.

Moving in together

Cohabiting couples do not have the protection that comes with marriage or civil partnership, but many still believe in the idea of so-called ‘common law marriage’, assuming they have legal rights on death, only to discover the harsh truth when the worst happens.

Some of the difficulties that play out for cohabiting couples have been touched upon above in relation to property and how to provide for children from a previous relationship. It cannot be emphasised enough that the only way to avoid uncertainty is by making a will. Otherwise, the division of assets belonging to a cohabitee will be decided by the intestacy rules, which do not provide for cohabiting partners. Typically, the whole of the estate would go to the children, or if they have none, to parents or other family members, and a surviving cohabitee may be turned out of the couple’s home if it was not held in shared ownership. While the survivor may have grounds to apply for financial provision under the Inheritance (Provision for Family and Dependants) Act 1975, this is a slow process and can be very costly.

Getting married

Many people do not realise that any existing will is automatically revoked when you get married or enter into a civil partnership, so together with the wedding cake and the honeymoon destination, this is an important item on the checklist. If you want to agree on what will happen to any assets that you bring to the marriage, whether this is your first or subsequent marriage, you may want to consider a pre-nuptial agreement that can set out the intentions on both sides.

Our specialist family lawyers can help you.

And as for your will, you don’t have to wait until you’ve completed the marriage or civil partnership ceremony to draw up a will that will be valid once you’re married, just so long as it has been made specifically in contemplation of that marriage or partnership.

Having children

This is one of the most life-changing events that can happen to us. While we are focused on how to protect our children on a day-to-day basis, we should not overlook the importance of protecting them if we were to die while they are young. If you have children under 18, you should use your will to appoint guardians, as the guardians will be legally responsible for the children if both parents die before the children become adults. While the children may live with the guardians, this is not always the case, and you can name one or more guardians to serve. You can also give a substitute or say what would happen if any named guardian were to separate or divorce.

Your will can set out your intentions on how the children are to be raised by the guardians, for example, their schooling or maintaining contact with grandparents or the age at which you would wish your children to inherit. Legally, this cannot be before 18, but you may wish for them to wait until they reach a more mature age, such as 25. And, if any child has any special circumstances that may affect their capacity to manage their inheritance or personal well-being, such as a disability or some form of drug or alcohol addiction, again, you can make provision for this.

Getting divorced

Often overlooked in the emotional upheaval of divorce is getting an up-to-date will in place. If you have an existing will that leaves everything to your spouse, it will remain valid until the decree absolute is confirmed, even if you have separated or received your decree nisi, meaning the spouse you are divorcing would benefit if those are the terms of your will.

Equally, if you do not have a will and something were to happen to you before the divorce is completed, then the intestacy rules would apply, and, again, it would be the spouse you are divorcing who would benefit, not any new partner, parents or siblings.

Note: This is not legal advice; it provides information of general interest about current legal issues.