When a shareholder dies, their shares are dealt with by the executors of their estate (if there is a will) or by the administrators under the Intestacy Rules (if there is no valid will). Both the executors and administrators are known as ‘personal representatives’ (PRs).

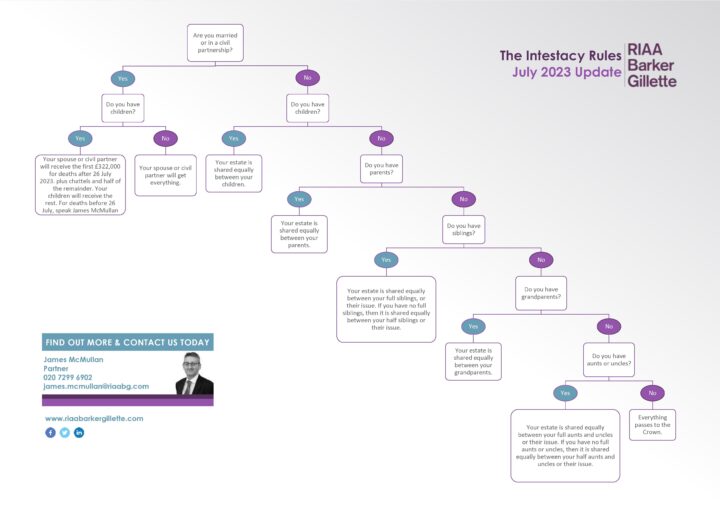

For a larger copy of the above image, please click here, or why not use our interactive online quiz instead?

What happens next with the shares depends on the terms of any shareholders’ agreement relating to the company in which the shares are held, the company’s articles of association and the ages of the beneficiaries of the shares.

Shareholders’ agreement

If a shareholders’ agreement exists, it is the first reference point in determining the next steps, as it may include rules about what happens to those shares in the event of a shareholder’s death.

Shareholders may have included provisions to prevent family members from becoming shareholders in a business they know nothing about. Or to stop the sale of a deceased shareholder’s shares to third parties.

The shareholders’ agreement may include rights (so-called ‘pre-emption rights’) that entitle the remaining shareholders (or some of them) to purchase the deceased shareholder’s shares before anyone else. Or there may be an option agreement triggered on death, which allows the beneficiaries to buy out the remaining shareholders.

Articles of association

PRs must next review the company’s articles of association for additional or supplemental provisions.

Under the default rules of the Model Articles, PRs can enter themselves into the company’s statutory registers as the holders of the deceased’s shares or, as appropriate, transfer the shares to particular persons.

Many companies have bespoke articles of association, which often include restrictions on the transfer of shares and may allow the directors to refuse to register new members. Any such share transfer restrictions will generally apply to transfers of shares on death.

If the shareholders’ agreement conflicts with the articles of association regarding any matters, the shareholders’ agreement will prevail. If the shareholders’ agreement is silent on any issues, the articles of association would determine the position.

Ages of beneficiaries

You must consider the ages of the beneficiaries to whom the shares pass.

If any beneficiaries are under 18 years old, then, depending on the will (if there is one), there are two options: either the PRs must form a trust to look after those children’s shares, or the children’s guardians receive their shares in the expectation that they will use them for the benefit of the children.

If the PRs form a trust, the trustees (who may be PRs or others) will administer the trust for the beneficiaries. The trust will own the shares, but the trustees will vote on company issues.

How we can help

Exit is one of the critical issues shareholders consider when setting up or becoming involved in any business. These plans must include providing for what happens if a shareholder dies.

If you need to put a shareholders’ agreement or bespoke articles of association in place, RIAA Barker Gillette’s experienced corporate and commercial team can prepare them.

We can also advise you on the terms of an existing shareholders’ agreement or articles of association and help ensure you incorporate appropriate provisions to death and other matters you may need to consider.

Call corporate solicitor Evangelos Kyveris today or speak to the head of our private client department, James McMullan.

Note: This article is not legal advice; it provides information of general interest about current legal issues.