James McMullan, Head of Private Client at RIAA Barker Gillette (UK), emphasises the importance of early planning to ensure that loved ones benefit fully from their inheritance.

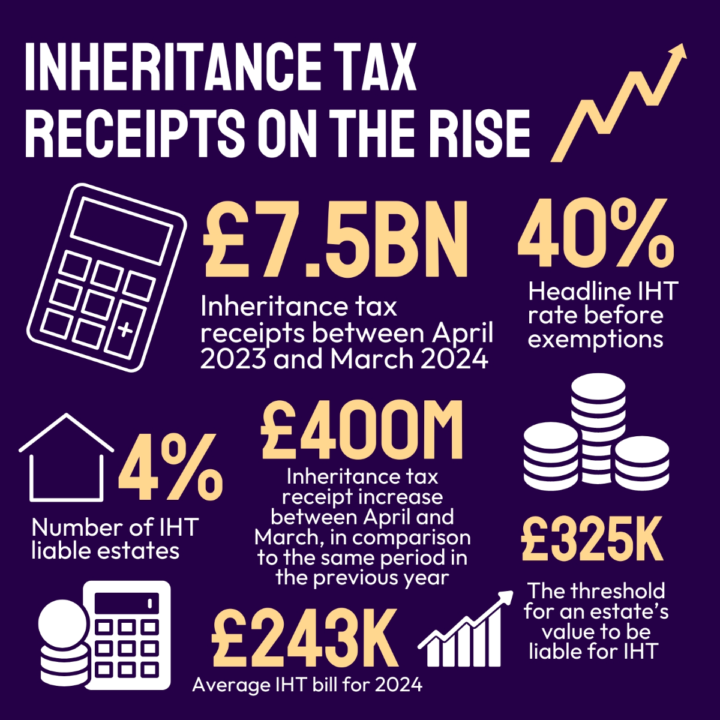

Rising Inheritance Tax Receipts

According to the latest figures from HM Revenue and Customs (HMRC), inheritance tax receipts have increased by 7.2% over the past year. This trend highlights the growing burden on estates, making it more crucial than ever for families to utilise available tax reliefs and plan effectively.

Expert Advice from The Association of Lifetime Lawyers

James McMullan, also a member of The Association of Lifetime Lawyers, advocates for precautionary measures to minimise the impact of IHT on family estates. He explains, “With more estates now liable for IHT, it’s essential to plan ahead to avoid a significant tax bill for your loved ones. If the value of your estate falls below the current nil rate band allowance of £325,000, no IHT is owed, provided this allowance hasn’t been reduced by relevant lifetime gifts.”

Key Strategies to Reduce Inheritance Tax

James outlines several strategies to mitigate IHT:

- Maximise Nil Rate Band Allowance: For married couples or civil partners who leave their entire estate to each other, the full transfer of the nil rate band to the surviving partner is permitted, effectively doubling the allowance to £650,000.

- Business and Agricultural Reliefs: Estates that include business or related assets may qualify for additional reliefs at rates of either 50% or 100%. Similarly, certain agricultural properties, such as land used for rearing animals or growing crops, can pass free of IHT if specific criteria are met.

- The Importance of a Valid Will: Creating a will is vital to ensure assets are distributed according to the individual’s wishes. Without a valid will, estates are divided according to intestacy rules, which may not align with the decedent’s intentions. Research from The Association of Lifetime Lawyers indicates that nearly half of UK adults (49%) do not have a will, underscoring the need for professional legal assistance in drafting this crucial document.

Staying Informed and Seeking Professional Guidance

James advises keeping abreast of potential policy changes, especially in light of recent governmental shifts, and consulting with a Lifetime Lawyer to help minimise IHT obligations.

About The Association of Lifetime Lawyers

Formerly known as Solicitors for the Elderly (SFE), The Association of Lifetime Lawyers is a membership body of highly qualified legal professionals specialising in supporting older people and those in vulnerable circumstances. Members receive expert training and best practice guidance to provide top-tier advice.

For individuals unable to afford a solicitor, The Association of Lifetime Lawyers recommends seeking advice from Citizens Advice, particularly for complex wills.

For further information, please contact James McMullan today.

Note: This article is not legal advice; it provides information of general interest about current legal issues.